On February 13th, the Trump administration presented the Fair and Reciprocal Tariff Plan (FRTP), signalling that it is ready to end the global trading system as we know it. Financial markets greeted the proposal with a shrug, lost in the flurry of Trump’s executive orders. But in terms of consequences for the global economy, it is the most significant of Trump’s proposals.

As trade tensions between the world’s largest economies intensify, Europe finds itself in a strategic and economic squeeze. The specter of “China Shock 2.0” looms over the continent, echoing the severe industrial decline and political dislocation that followed China’s entry into the World Trade Organization (WTO) in 2001. European industries, especially in sectors like automotive and machinery, now face unprecedented pressure from both the surge in Chinese exports and the tightening grip of U.S. protectionism.

The prospect of a “Rust Belt upon the Rhine” is no longer hyperbole but a potential reality, as Europe risks reliving the economic stagnation and social turmoil that beset parts of the United States after its own trade shock. Without a concerted response, this economic stress could once again translate into political polarization, populism, and further fracturing of the European Union’s unity.

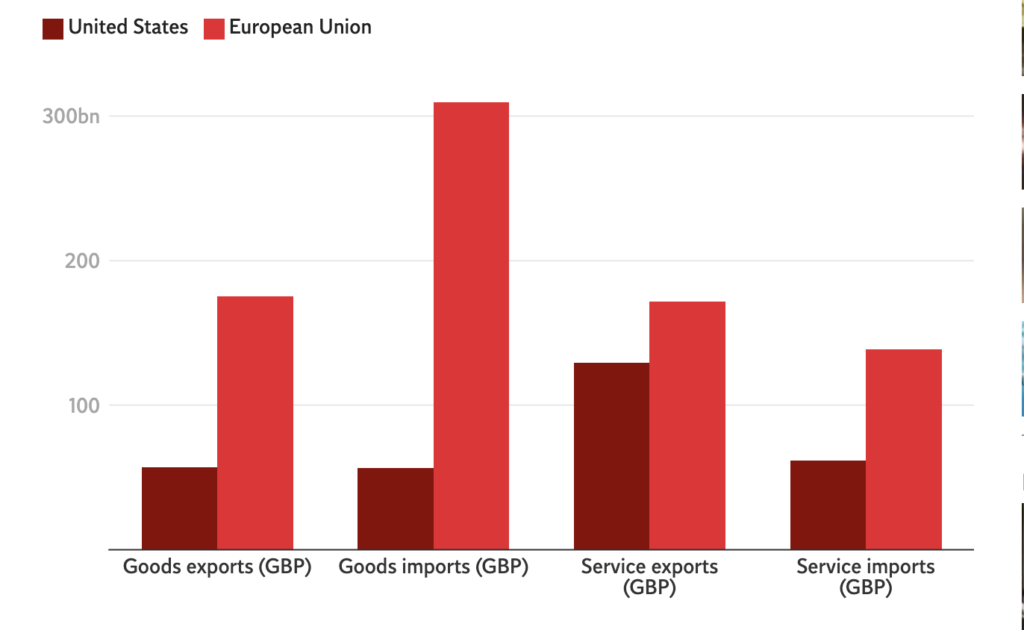

As a whole trading bloc, the EU dominates UK trade (£795 billion), and surpasses the US in particular when it comes to goods trade (£247 billion). Services are more evenly split, with the UK exporting a high value-amount of services (£129 billion) to the United States in the past year.

The U.S. Tariff Offensive and Strategic Dilemmas

The latest wave of U.S. tariffs, initiated under the Trump administration, has sent shockwaves across global trade systems. Despite a temporary reprieve granted to European exports, the EU faces a dilemma: whether to align with the United States against China or to chart a more independent course that might include deeper engagement with Beijing. For many, including former European Commissioner for Trade Cecilia Malmström, this is a moment for diversification. Europe, she argues, must not only defuse tensions with Washington but also build new bridges in global trade—finalizing agreements with Latin American and Southeast Asian nations and potentially joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Yet, Malmström and others recognize the double-edged nature of the EU-China relationship. While China offers advanced green technologies and market opportunities, it also presents structural risks: from unfair subsidies and overcapacity to deep strategic dependencies in critical sectors like rare earth minerals.

China: Partner, Rival, or Economic Predator?

China’s economic model, reliant on state-driven overproduction and export-led growth, poses unique challenges to Europe. As the United States reduces its import demand, China is shifting its excess industrial output towards Europe. Economist Sander Tordoir warns that this flood of Chinese goods—from electric vehicles to solar panels and heavy machinery—could severely undercut Europe’s industrial base. Unlike the United States, Europe lacks the political and military leverage to force China into major economic concessions, making trade defense measures the last resort.

Tordoir advocates for a pivot in EU strategy: from dependency on volatile global markets to revitalizing internal demand through industrial policy. Without such a shift, Europe remains exposed, vulnerable to both the hammer of Chinese overcapacity and the anvil of U.S. tariffs.

Trust Deficit on Both Fronts

Trust in transatlantic relations is fraying. As Zsuzsa Anna Ferenczy notes, Trump’s erratic tariff policies and disregard for allied interests have destabilized longstanding partnerships. European leaders, wary of being caught in another geopolitical tug-of-war, have paused retaliation in favor of negotiations—but patience is wearing thin.

Meanwhile, the prospect of rebuilding trust with China seems even more tenuous. Beijing’s economic coercion, exemplified by sanctions on European officials, and its strategy of dividing Europe from the U.S. underscore the need for caution. Ferenczy urges the EU to resist the illusion of relief through alignment with China, which could compound Europe’s economic vulnerabilities and weaken its geopolitical position.

De-risking, Not Decoupling

Europe’s current doctrine is “de-risking”—an attempt to manage dependencies and strategic exposure without fully decoupling from China. However, as Georgios Papakonstantinou argues, de-risking now applies as much to the United States as it does to China. In a world where Washington demands loyalty while Beijing offers incentives, Europe must carefully navigate between competing superpowers.

Papakonstantinou suggests starting with shared interests: climate action, green energy, and global governance reforms. These areas offer the potential for mutually beneficial cooperation with China, even amid deep ideological and systemic differences. Yet, such collaboration must be tempered with strategic clarity and protective safeguards.

Strategic Investment and Technological Sovereignty

Technological competition sits at the core of the EU-China tension. Maaike Okano-Heijmans underscores the danger of China’s dumping of artificially cheap high-tech products. While some in Europe consider loosening export restrictions to appease China, Okano-Heijmans cautions that this will not curb Beijing’s pursuit of self-reliance. Instead, the EU should double down on its own tech capabilities and invest in emerging sectors to remain globally competitive.

Strategic autonomy requires alliances beyond Washington and Beijing. Cooperation with like-minded democracies—Japan, South Korea, and India—can help the EU demonstrate to the Global South that multilateralism still has a future.

A Turning Point: Leverage or Capitulation?

Noah Barkin sees a silver lining in the chaos. Trump’s tariffs have inadvertently increased Europe’s leverage. In the lead-up to the July EU-China summit, the bloc has a rare window to demand concrete concessions from Beijing: reducing overcapacity, investing in European manufacturing, respecting data governance, and ensuring fair market practices. If China refuses, Europe must be prepared to impose its own defensive measures.

Europe cannot afford to retreat. Any sign of weakness will not placate Beijing or deter Washington. Instead, the EU must assert its economic interests with clarity, invest in strategic industries, and enforce fair trade practices. This is not merely a matter of competitiveness, but of political survival.

As the global order fractures, Europe must resist the temptation of short-term relief and focus on long-term resilience. The continent stands at a crossroads: one path leads to diminished sovereignty and economic subjugation; the other, to strategic independence and renewed global leadership. The choice lies in Europe’s willingness to act decisively—to turn crisis into opportunity and forge a future on its own terms.