InDepthReports

The European Union is once again preparing to test its unity, energy resilience, and political resolve. This week, the European Commission confirmed it is exploring the inclusion of Russian liquefied natural gas (LNG) in the bloc’s forthcoming 19th sanctions package against Moscow. The measure, if adopted, would mark a dramatic acceleration of Europe’s energy decoupling from Russia, closing one of the last significant loopholes left in its sanctions regime.

But the move is fraught with peril. It risks sparking short-term market turmoil, legal disputes with energy companies, and political fault-lines between member states still dependent on Russian supplies. And as ever with sanctions, the effectiveness of a European embargo will depend on whether Brussels can close the door to circumvention via global intermediaries.

Why Now: The Politics Behind the Push

The European Commission’s latest pivot on LNG did not emerge in a vacuum. For months, pressure had been building within the EU and across the Atlantic to take stronger action against the last remaining flows of Russian fossil fuels entering European markets.

Commission President Ursula von der Leyen set the tone in mid-September when she announced that the EU “must accelerate the phase-out of Russian oil and gas” after consultations with international partners. Sources in Brussels confirm that this was not simply rhetoric. Officials are actively drafting sanctions language that could, for the first time, restrict seaborne Russian LNG cargoes.

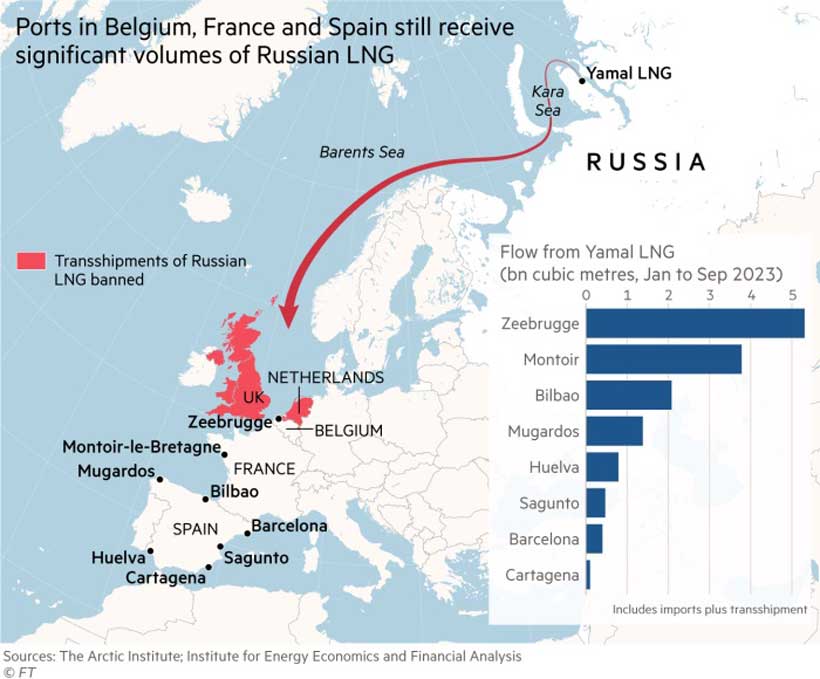

Political signals from Spain — one of Europe’s largest importers of LNG — have added fuel to the fire. Economy Minister Carlos Cuerpo declared that Madrid was “cutting Russian gas imports” while supporting efforts to repurpose frozen Russian assets to aid Ukraine. That stance matters: Spain, Belgium, France, and the Netherlands still host LNG cargoes from Russian exporters. A shift in Madrid’s position gives the Commission new leverage to propose a tougher line.

Transatlantic politics also play a role. Washington has pressed Brussels to tighten its sanctions, framing LNG restrictions as part of a united front to squeeze Moscow’s revenues. U.S. officials see an LNG ban not only as a geopolitical move but also as an opportunity for American exporters to expand their footprint in Europe’s energy markets.

What Exactly Is on the Table

The EU has already agreed in principle to phase out Russian oil and gas imports by 2028. The question is whether that timeline can be accelerated — and whether LNG can be brought under sanctions sooner.

Draft discussions in the Commission suggest that Russian LNG could be targeted in one of two ways:

- A direct ban on cargoes loaded at Russian ports.

- A broader ownership ban, blocking imports from Russian-controlled companies regardless of where the LNG is shipped.

Each option carries risks. A narrow ban on Russian-port cargoes would be easier to implement but leaves loopholes for re-labelling or ship-to-ship transfers. A broader ban raises complex legal and contractual questions — especially concerning existing long-term supply agreements.

Officials are also weighing whether to “grandfather” existing contracts, allowing them to continue until expiry, or to impose a clean break. Carve-outs for landlocked countries such as Hungary and Slovakia, still reliant on Russian pipeline gas, are likely to be debated intensely.

Who Supports and Who Resists

Europe’s internal divisions on Russian energy remain as sharp as ever.

Supporters:

A bloc of northern and western states — including Denmark, Finland, the Czech Republic, and now Spain — favor a tougher approach. For them, energy decoupling is not just economic but strategic, aimed at permanently reducing Moscow’s leverage over Europe.

Resisters:

Hungary and Slovakia have long resisted energy sanctions, citing security-of-supply risks and high domestic costs. Both countries secured exemptions in earlier sanctions packages and are expected to push for carve-outs again. Other smaller importers with limited infrastructure may quietly back them.

The Brussels Game:

The Commission can propose measures, but adoption depends on qualified majority backing in the Council. Past experience suggests weeks of hard bargaining between capitals, with the risk that any LNG ban is diluted by exemptions or delayed implementation.

Market Impact: Cutting a Key Revenue Stream

Russian gas flows to Europe have already fallen dramatically since the invasion of Ukraine in 2022. Yet LNG remains a lifeline for Moscow, with Europe still absorbing between 13 and 19 percent of its imports in 2025 depending on the season.

The revenue stakes are high. LNG exports deliver billions annually to Russia’s state coffers, funds that European policymakers say are helping to finance Moscow’s war machine. Cutting them off would be symbolically and materially significant.

But the risks for Europe are also real. Removing Russian cargoes from the market could:

- Trigger short-term price spikes in wholesale gas markets.

- Force importers in Spain, France, and Belgium to scramble for replacement supply.

- Create legal disputes over broken contracts, potentially costing taxpayers billions.

Industry analysts at S&P Global estimate that sanctions-driven disruptions could redirect “tens of billions of dollars in investment” toward U.S. LNG projects, reshaping global trade flows. American exporters, already Europe’s top LNG suppliers, stand to benefit disproportionately from a European ban.

Legal and Enforcement Headaches

Sanctioning LNG is easier said than done.

- Origin Verification: Unlike oil, LNG molecules are indistinguishable. Determining whether a shipment is “Russian” depends on documentation — where it was loaded, who sold it, who owns the cargo. That opens the door to fraud.

- Trans-shipment Loopholes: Russia has used ship-to-ship transfers and third-country intermediaries to disguise cargo origins. Without strict monitoring, Russian LNG could continue flowing into Europe under different flags.

- Contractual Litigation: Energy companies locked into long-term LNG contracts may sue if they are forced to break agreements. The Commission has explored force majeure clauses, but the legal risks are enormous.

As one Brussels-based lawyer put it: “Every cargo that is blocked will end up in court.”

Circumvention Risks and Global Fallout

Even if Europe bans Russian LNG, Moscow can reroute exports to Asia. China, India, and Turkey have already absorbed discounted Russian oil. LNG could follow the same path, blunting the financial impact of a European embargo.

Secondary sanctions — targeting intermediaries who re-export to Europe — would strengthen the EU’s hand but require coordination with the U.S. and other allies. Otherwise, the ban could simply rearrange global trade flows without significantly reducing Moscow’s revenues.

There is also the paradox of price. By reducing supply in Europe, a ban could temporarily raise global LNG prices — allowing Russia to earn more from sales elsewhere.

Voices from the Field

- Ursula von der Leyen, European Commission President: “Europe must close the last loopholes of Russian energy dependence.”

- Carlos Cuerpo, Spanish Economy Minister: “Spain is cutting Russian gas imports while diversifying our supply. Europe must stand firm.”

- Energy Analyst, S&P Global: “Each sanction shifts billions in LNG investment — this one could reshape the global market.”

What Happens Next

The Commission is expected to circulate draft sanctions language in the coming weeks. The usual process will follow: review by the College of Commissioners, debate in the Council’s working groups, and haggling among national capitals.

Diplomats say the timeline is tight. A deal could be struck before winter — when energy security becomes politically explosive — or pushed into 2026 if divisions prove insurmountable.

Either way, Europe is entering uncharted waters. The 19th sanctions package could mark the moment when Brussels finally closes the tap on Russian gas. Or it could reveal, once again, the limits of European unity when energy security is on the line.

Conclusion: Europe’s Energy Reckoning

The EU’s deliberations on Russian LNG are more than a technical debate over cargoes and contracts. They strike at the heart of Europe’s struggle to balance values and interests in the wake of war.

Sanctions are easy to announce but difficult to enforce. Energy markets are global, contracts are binding, and political will is fragile. Yet if Brussels succeeds in banning Russian LNG, it will mark a milestone in the continent’s strategic independence.

The question is whether Europe is ready — politically, economically, and socially — to pay the price of cutting the final cord to Moscow.

Fact Box: How LNG Origin Is Certified

- Point of Loading: Customs declarations at export terminal.

- Ownership Chain: Bills of lading, cargo documentation.

- Verification Challenges: Ship-to-ship transfers, flag changes, offshore intermediaries.

Timeline: EU Energy Sanctions 2022–2025

- 2022: Ban on Russian coal; oil embargo with pipeline exemptions.

- 2023: Ban on new LNG contracts; partial restrictions on imports.

- 2024: Gas imports reduced by over 60%; new U.S. LNG deals signed.

- 2025: Drafting of 19th sanctions package, including potential LNG ban.